Personal / Family Trust

Personal Trust

A personal trust is a kind of trust business, created by the individual (Settlor/Trustor) for the interest of himself or any third party (“Beneficiary”) specially assigned by himself in order to transfer the asset/property to be managed/ administrated/ safe kept by the BIC Trust via the Trust deed. Personal trusts are separate legal entities that have the authority to buy, sell, hold, and manage property for the benefit of their trustors.

Family Trust

A family trust is a way to protect the Settlor’s assets for himself and his family in the future. With this arrangement, the assets such as your family home are owned and controlled by BIC Trust for the benefit of beneficiaries, who are likely to be yourself, your spouse, and your children. Setting up a family trust allows you to control how your assets will be used after you die.

For example, you can decide how assets are left to your minor children or grandchildren. The main advantage is the property in a family trust does not go through the probate process when you die. Probate can be time-consuming, and avoiding it means beneficiaries get access to the property much faster.

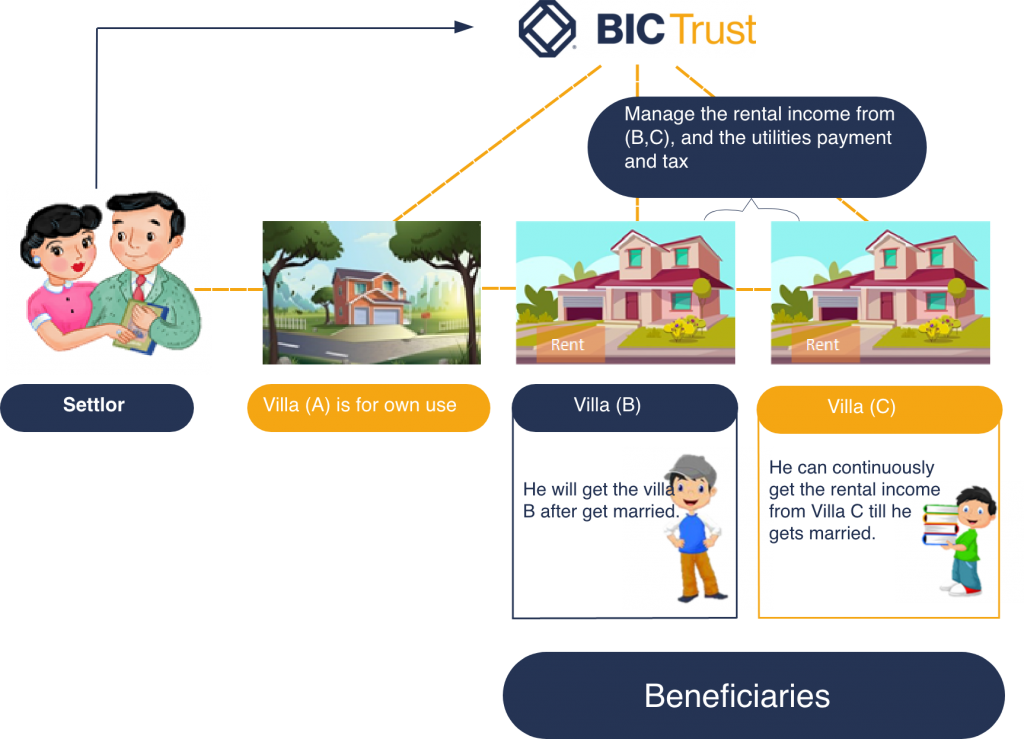

Case Study

Mr. and Mrs. WANG are 40-years-old, having two minors. They have three villa units, one of them (A) is for own use and the other two (B, C) are for investment and generate rental income. They appoint BIC Trust as their wealth inheritance management, in order to make sure no matter whatever happens their assets are managed according to their wishes, their children can inherit their wealth. They also assign BIC Trust to manage the rental income from (B, C), and the utility payment and tax service. They also wish details about the separation and transfer of their property based on the terms and conditions of the Trust deed. BIC Trust shall transfer the ownership of villa B to the married child if one of their children gets married, at the same time, the other child can continuously get the rental income from Villa C till he gets married.